Is Corporation Tax Vat Exempt . what is vat? unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. basics of vat exemption. If all the goods and services you sell are exempt, your. Some goods and services are exempt from vat. You must register for vat. While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. To prevent items from being taxed. Vat (value added tax) is paid to hmrc by all limited companies that register for it. You must pay corporation tax on profits from doing business as: As outlined by hmrc, corporation. Any foreign company with a uk. corporation tax is a type of business tax applied to profits from doing business.

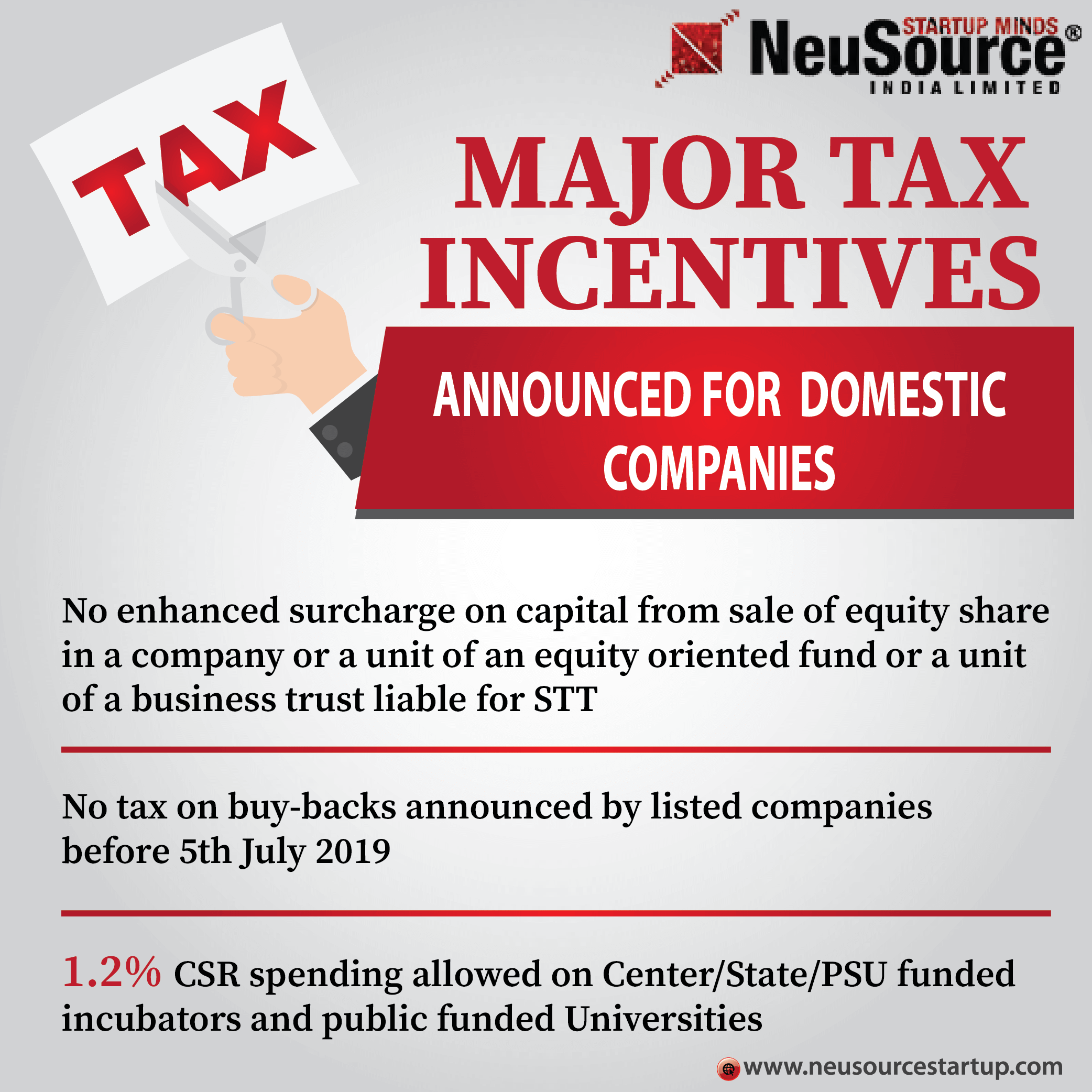

from www.neusourcestartup.com

Some goods and services are exempt from vat. If all the goods and services you sell are exempt, your. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. You must register for vat. To prevent items from being taxed. Vat (value added tax) is paid to hmrc by all limited companies that register for it. You must pay corporation tax on profits from doing business as: corporation tax is a type of business tax applied to profits from doing business. Any foreign company with a uk. what is vat?

Corporate Tax Exemption for Companies and Startup India in Budget 2020

Is Corporation Tax Vat Exempt basics of vat exemption. Vat (value added tax) is paid to hmrc by all limited companies that register for it. Any foreign company with a uk. As outlined by hmrc, corporation. To prevent items from being taxed. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. basics of vat exemption. corporation tax is a type of business tax applied to profits from doing business. While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. You must register for vat. If all the goods and services you sell are exempt, your. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. You must pay corporation tax on profits from doing business as: what is vat? Some goods and services are exempt from vat.

From www.studocu.com

VAT Exempt Notes BUSINESS TAX VAT EXEMPT 1. EXEMPT ON IMPORTATION A Is Corporation Tax Vat Exempt basics of vat exemption. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. If all the goods and services you sell are exempt, your. You must pay corporation tax on profits from doing business as: Any foreign company with a uk. Some goods and services are exempt. Is Corporation Tax Vat Exempt.

From www.accountingfirms.co.uk

VAT Exemption Items What is VAT Exempt in the UK? Is Corporation Tax Vat Exempt While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. Vat (value added tax) is paid to hmrc by all limited companies that register for it. To prevent items from being taxed. basics of vat exemption. Any foreign company with a uk. You must pay corporation tax. Is Corporation Tax Vat Exempt.

From www.youtube.com

What is the difference between zero rated and vat exempt ? vat ex Is Corporation Tax Vat Exempt No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. You must pay corporation tax on profits from doing business as: As outlined by hmrc, corporation. While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. To. Is Corporation Tax Vat Exempt.

From www.neusourcestartup.com

Corporate Tax Exemption for Companies and Startup India in Budget 2020 Is Corporation Tax Vat Exempt You must register for vat. While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. As outlined by hmrc, corporation. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. what is vat? No vat is. Is Corporation Tax Vat Exempt.

From www.cpadavao.com

Process Flow of Applying for Tax Exemptions of Corporations and Is Corporation Tax Vat Exempt what is vat? If all the goods and services you sell are exempt, your. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. corporation tax is a type of business tax applied to profits from doing business. basics of vat exemption. unlike sales tax,. Is Corporation Tax Vat Exempt.

From www.uk-vat-advice.co.uk

VAT Exemption What you need to know Is Corporation Tax Vat Exempt You must register for vat. You must pay corporation tax on profits from doing business as: Any foreign company with a uk. If all the goods and services you sell are exempt, your. While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. basics of vat exemption.. Is Corporation Tax Vat Exempt.

From www.taxadvisermagazine.com

Partial exemption in VAT registered businesses Tax Adviser Is Corporation Tax Vat Exempt If all the goods and services you sell are exempt, your. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. Any foreign company with a uk. Vat (value added tax) is paid to hmrc by all limited companies that register for it. corporation tax is a type. Is Corporation Tax Vat Exempt.

From farahatco.com

VAT Exemption in UAE Products and Services Exempt From VAT Is Corporation Tax Vat Exempt Some goods and services are exempt from vat. basics of vat exemption. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. unlike sales tax,. Is Corporation Tax Vat Exempt.

From quickbooks.intuit.com

How to apply for VAT exemption QuickBooks UK Blog Is Corporation Tax Vat Exempt what is vat? No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. If all the goods and services you sell are exempt, your. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. You must register. Is Corporation Tax Vat Exempt.

From www.slideserve.com

PPT VAT value added tax PowerPoint Presentation, free download ID Is Corporation Tax Vat Exempt No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. Vat (value added tax) is paid to hmrc by all limited companies that register for it. You must register for vat. unlike sales tax, vat is levied on all stages of the production process, meaning that there are. Is Corporation Tax Vat Exempt.

From kgrnaudit.com

What Is The taxable & Exempt For Corporate? Is Corporation Tax Vat Exempt Some goods and services are exempt from vat. what is vat? Any foreign company with a uk. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. To prevent items from being taxed. Vat (value added tax) is paid to hmrc by all limited companies that register for. Is Corporation Tax Vat Exempt.

From alliance-acc.com

UAE CT Update Corporate Tax Exemption for Public and Community Welfare Is Corporation Tax Vat Exempt corporation tax is a type of business tax applied to profits from doing business. basics of vat exemption. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale exemptions. You must pay corporation tax on profits from doing business as: To prevent items from being taxed. If all. Is Corporation Tax Vat Exempt.

From legaldbol.com

33 Format Vat Exempt Invoice Template in Word with Vat Exempt Invoice Is Corporation Tax Vat Exempt If all the goods and services you sell are exempt, your. You must pay corporation tax on profits from doing business as: While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. what is vat? Vat (value added tax) is paid to hmrc by all limited companies. Is Corporation Tax Vat Exempt.

From www.slideserve.com

PPT VAT for Managers Ian M Harris Leicester City Council VAT Is Corporation Tax Vat Exempt You must pay corporation tax on profits from doing business as: To prevent items from being taxed. Some goods and services are exempt from vat. what is vat? basics of vat exemption. As outlined by hmrc, corporation. corporation tax is a type of business tax applied to profits from doing business. No vat is charged on exempt. Is Corporation Tax Vat Exempt.

From www.bayut.com

All About VAT Exemptions in the UAE and Zero Rate MyBayut Is Corporation Tax Vat Exempt what is vat? Vat (value added tax) is paid to hmrc by all limited companies that register for it. Some goods and services are exempt from vat. Any foreign company with a uk. As outlined by hmrc, corporation. You must register for vat. To prevent items from being taxed. If all the goods and services you sell are exempt,. Is Corporation Tax Vat Exempt.

From kgrnaudit.com

Who Is Exempt From UAE Corporate Tax(CT)? Is Corporation Tax Vat Exempt As outlined by hmrc, corporation. If all the goods and services you sell are exempt, your. You must register for vat. corporation tax is a type of business tax applied to profits from doing business. No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. Any foreign company. Is Corporation Tax Vat Exempt.

From www.slideserve.com

PPT VAT value added tax PowerPoint Presentation, free download ID Is Corporation Tax Vat Exempt No vat is charged on exempt items or services, and the supplier cannot claim input vat as a credit or refund. what is vat? While standard vat is 20% on most goods and services, there is a reduced rate of 5% on some goods and services. Vat (value added tax) is paid to hmrc by all limited companies that. Is Corporation Tax Vat Exempt.

From www.cztaxaccounting.ae

UAE Corporate Tax Exemptions & Deductions CZ Tax & Accounting Is Corporation Tax Vat Exempt As outlined by hmrc, corporation. Vat (value added tax) is paid to hmrc by all limited companies that register for it. To prevent items from being taxed. Some goods and services are exempt from vat. You must register for vat. unlike sales tax, vat is levied on all stages of the production process, meaning that there are no resale. Is Corporation Tax Vat Exempt.